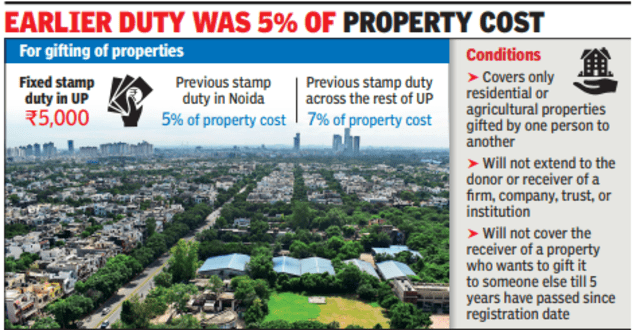

Gifting property? Uttar Pradesh relaxes stamp duty to a flat Rs 5,000

NOIDA: The state government has fixed a maximum stamp duty of Rs 5,000 for gifting properties. Earlier, the stamp duty was 5% of the cost of properties in the city and 7% of the cost of properties in other parts of the state.

The notification issued by principal secretary Leena Johri on August 3 stated, “Such gift deed, whereby the donor transfers immovable property in favour of family members, such as son, daughter, father, mother, husband, wife, daughter-in-law, real brother (his wife in case of death of real brother), real sister, son-in-law, son/daughter of son/daughter, the maximum stamp duty will be Rs 5,000.”

The notification covers only residential or agricultural properties gifted by one person to another and will not extend to the donor or receiver of a firm, company, trust, or institution. Also, if a person receives a property as gift, the notification will not cover them if they gift the property to someone else till 5 years have passed since the property registration date.

The notification also stated that exercising the powers under clause (a) of sub-section (1) of Section 9 of the Indian Stamp Act, 1899, the governor has fixed the stamp duty until further orders.

B S Verma, assistant inspector general of stamp and registry, said that the government had launched this scheme for 6 months in June 2022. “The scheme ended in December 2022 because it was only for 6 months. But this time, the notification will remain effective until further orders. It will help several people who want to transfer or gift properties to family members,” he said, adding that earlier, the stamp duty would amount to Rs 5 lakh for transferring a Rs 1 crore flat or property, but it has now come down to Rs 5,000 only.Verma further said that to expedite the registration of thousands of flats in Noida and Greater Noida, a high-level meeting was held in Lucknow last week, where the Authorities decided to give subsidies to the developers against the pending dues to facilitate the registration of flats. However, the stamp and registry department has not received an official order in this effect so far, added Verma.