IBM in advance talks with TRIL to lease 2.6 lakh sq ft office space in Gurugram

Representative image

Representative imageUS technology major IBM is reportedly in advanced discussions to lease 260,000 square feet of office space at Gurugram‘s TRIL Tower, developed by Tata Realty, two people familiar with the matter told ET.

Absorption of Grade A office space was hitherto led by the return-to-office routine for major technology companies, but several other demand drivers are expected to help sustain the momentum.

The emergence of new Global Capability Centres (GCCs), expanding presence of flexible workspace operators, the rise in unicorn startups, and ongoing growth of the Big Tech will continue to fuel office-space demand, industry experts said.

“A lot of space that was part of the SEZ is getting denotified now, opening up newer areas for corporations. Tata also has a large portfolio under SEZ and is getting it denotified,” said a consultant on the condition of anonymity.

Earlier, Ciena, a US networking systems, services and software company, leased 135,000 square feet of office space at Gurugram’s TRILTower by Tata Realty. The rental and other details of the lease deal are not known.

IBM and TRIL did not respond to ET’s emailed queries.

“The Gurugram NCR region is witnessing the emergence of new quadrants of development, driven by a strong ‘flight to quality’ trend,” said Peush Jain, managing director, commercial leasing and advisory, Anarock. “Companies are prioritising better infrastructure, institutional ownership, and top-tier amenities as they elevate their workplace strategies to align with employee engagement and operational excellence.”

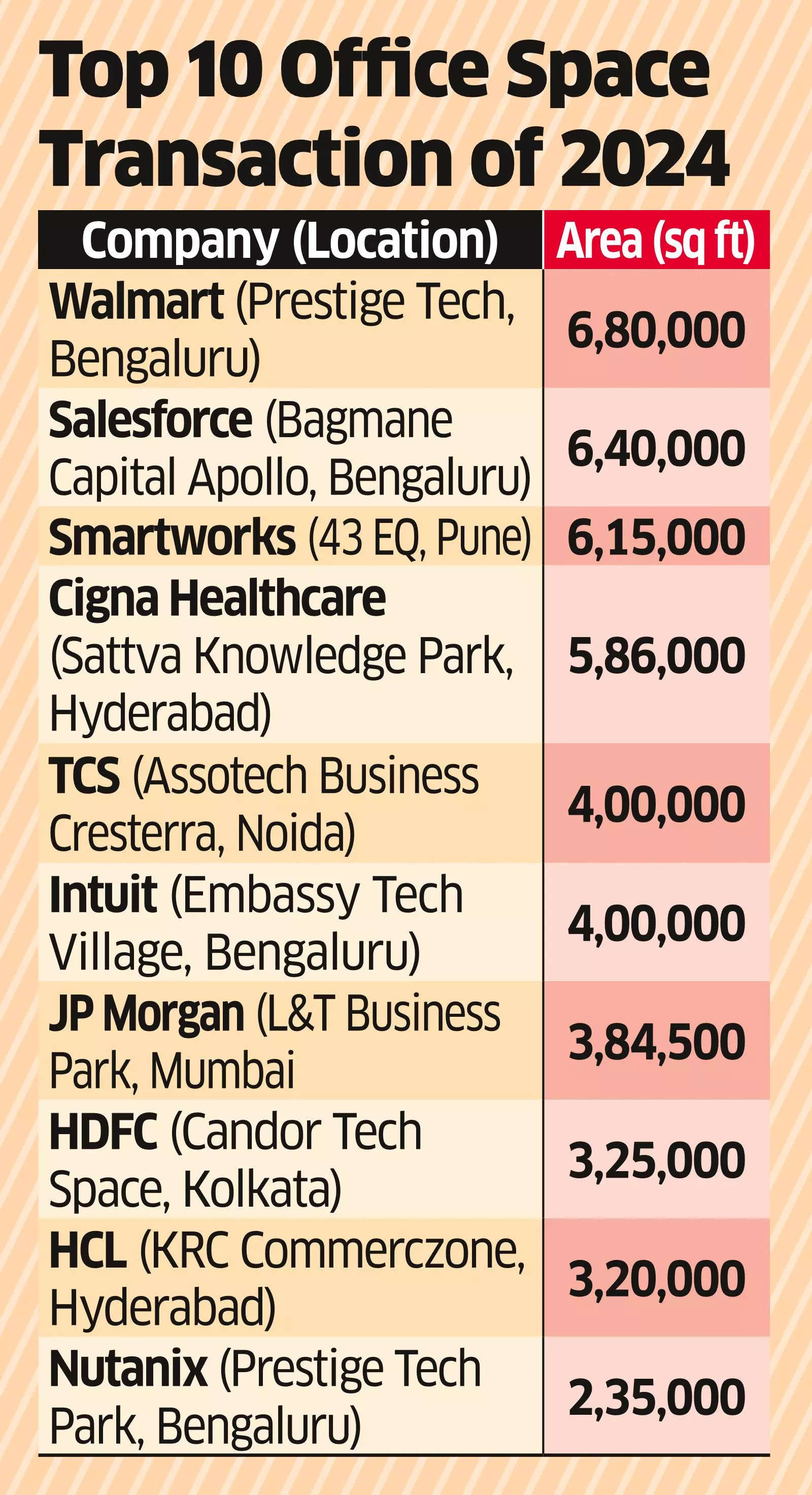

Office space leasing is set to scale a record 83-85 million square feet this calendar year, marking a 13% increase over the previous peak in 2023, real estate consultancy firm Cushman & Wakefield said in a report.

India has emerged as a bright spot in the office leasing market globally at a time when the realty sectors in the US and China are facing challenges. Within the Asia-Pacific (APAC), India is expected to contribute nearly 70% of the region’s total net absorption by this year-end, underscoring its market dominance.

According to Cushman & Wakefield, India’s growing appeal as a hub for Global Capability Centres (GCCs) is propelling demand, with GCCs currently contributing to 30% of the gross leasing volume (GLV)-a share that is expected to increase further.